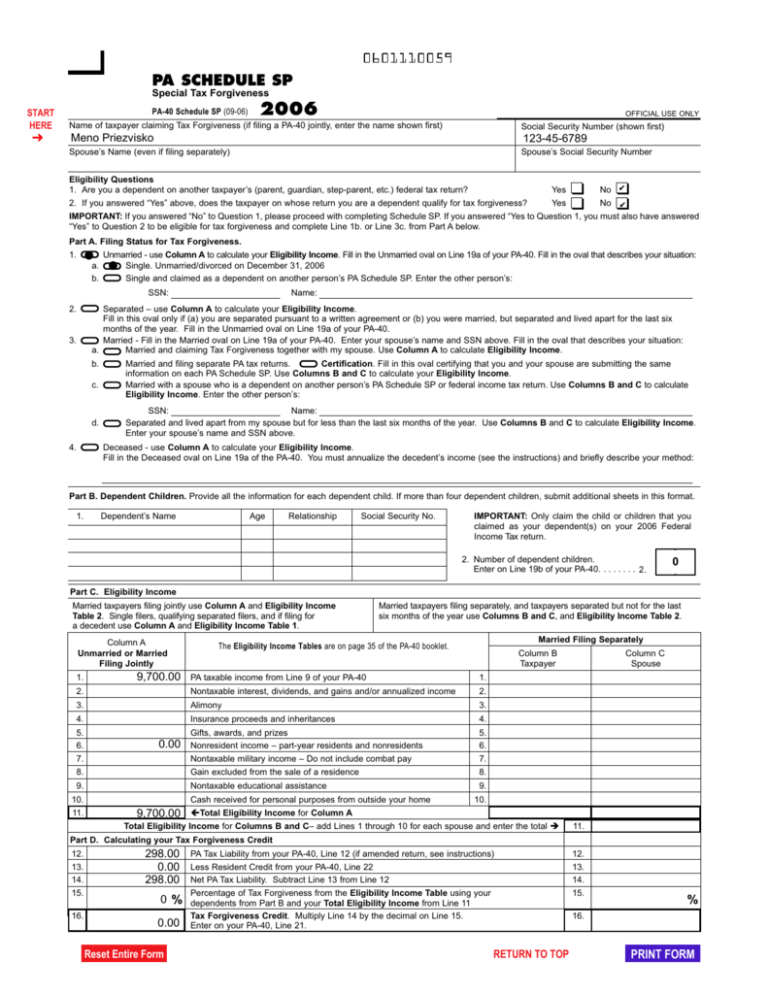

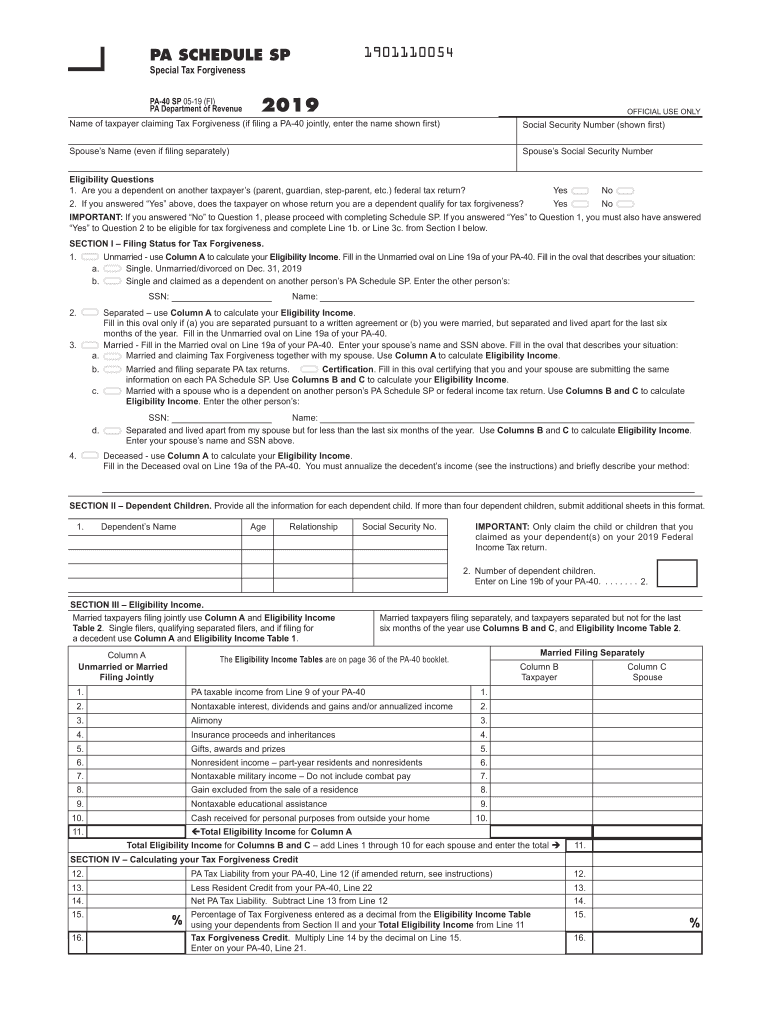

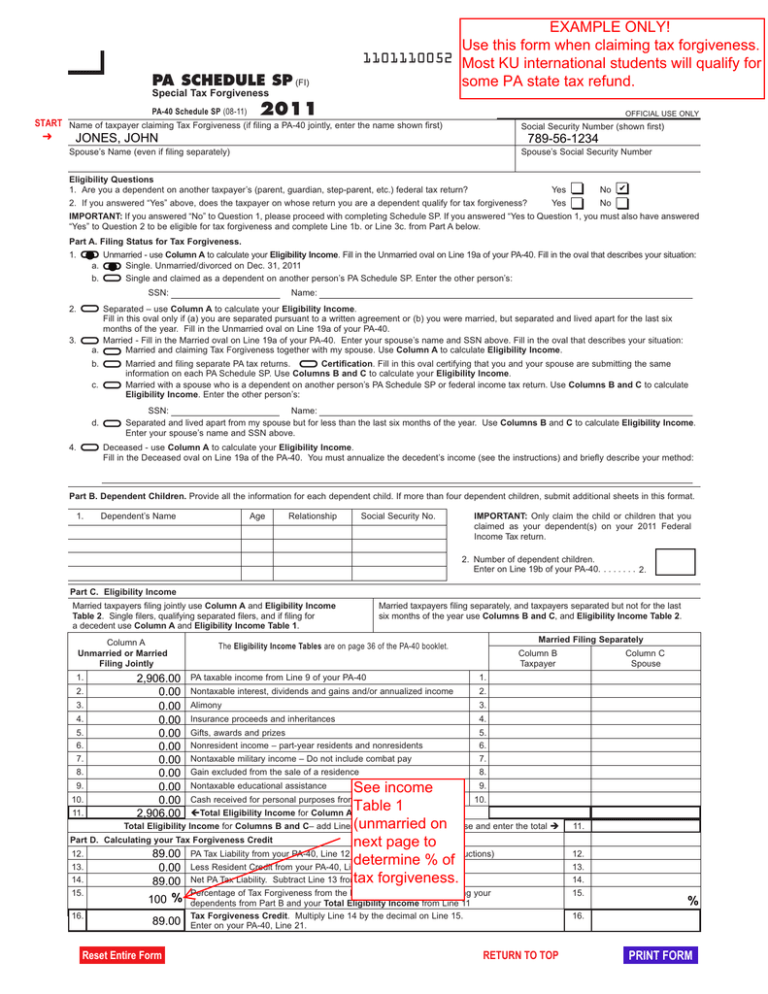

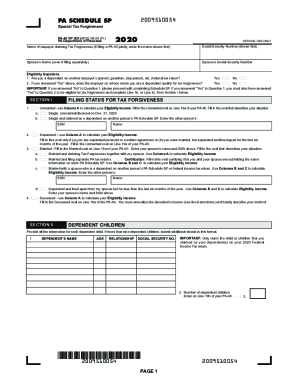

tax forgiveness credit pa schedule sp

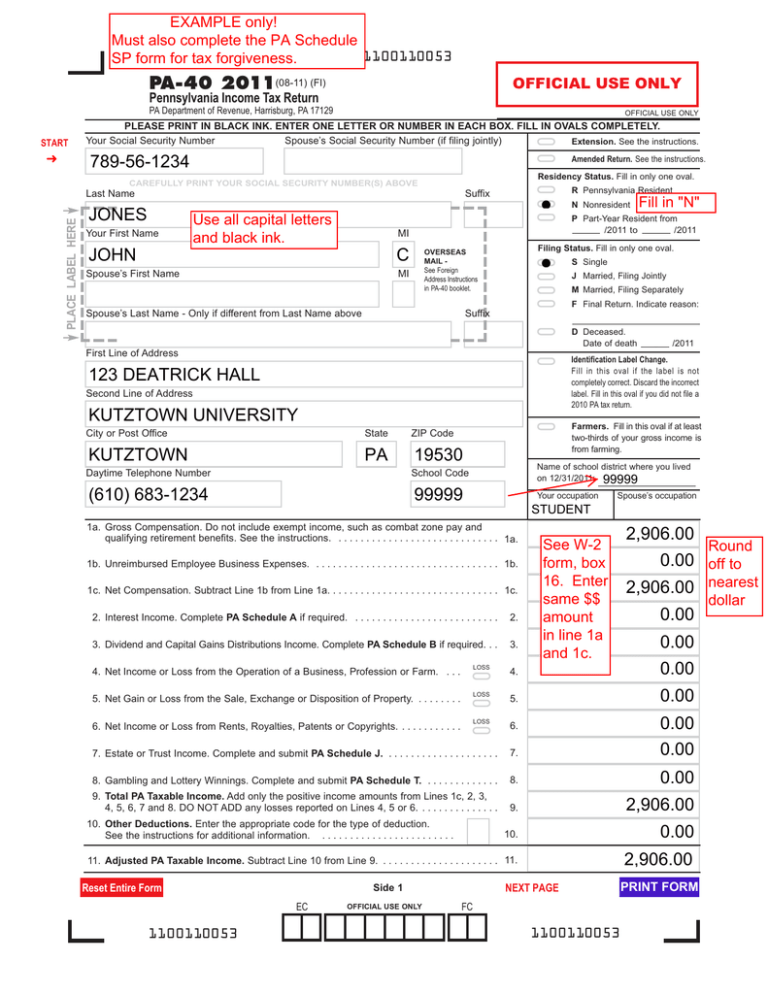

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. How to File a PA-40 and Claim Tax Forgiveness For taxpayers subject to employer withholding one easy way to file your Pennsylvania Personal Income Tax Return PA-40 and the additional form Schedule SP is by using myPATH the Department of Revenues free online filing system.

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Tax Forgiveness is a credit that allows eligible taxpayers toreduce all or part of their PA tax liability.

. To force PA Schedule SP. I think my client qualifies for the PA special tax forgiveness credit but Schedule SP is not being produced. Determine the amount of Pennsylvania-taxable income.

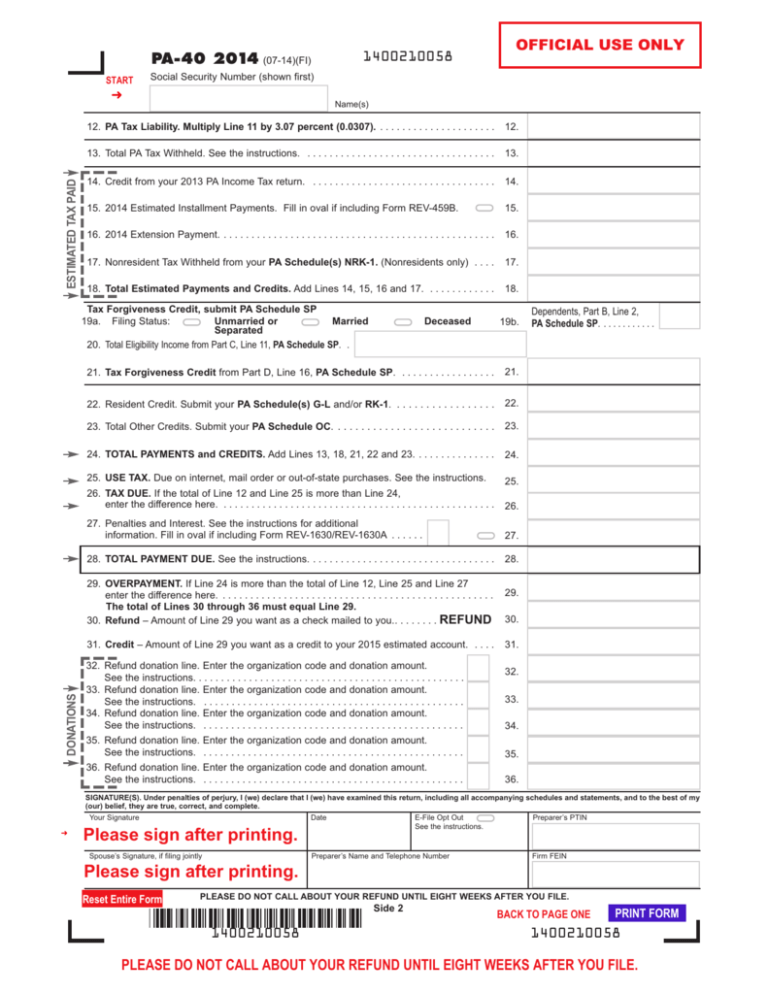

To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. You can go to the ForceSuppress the credit field at the bottom of the PA SP screen and from the drop list select F.

3 rows PA Schedule SP Eligibility Income Tables. This will force the PASP to print so you can see. A single or unmarried claimant determines only his or her own amount of taxable income.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. On PA-40 Schedule SP the claimant or claimants must. You may NOT claim a dependent child on PA Schedule SP if.

For more information please see. Gives a state tax refund to some taxpayers. Fill in the Unmarried oval on Line 19a of your PA-40.

Click section 2 - Tax Forgiveness Credit Schedule SP. Insurance proceeds and inheritances- Include the total proceeds received from life or other insurance policies to include inherited cash or the value of property received. You are unmarried and your former spouse can.

You cannot claim the child on your federal return. PA Schedule SP - Special Tax Forgiveness View all 175 Pennsylvania Income Tax Forms Disclaimer. To claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SP.

Unmarried - use. Form PA-40 SP requires you to list multiple forms of income such as wages interest or alimony. To enter this credit within the program please follow the steps below.

The dependent is not your child. To complete PA Schedule SP Part C Line 6. The PA Schedule SP will produce if the TP SP qualify.

Input line 1 - Input Code for Schedule SP. Further to qualify for the credit it is necessary to calculate both the taxable and nontaxable income. A 2-parent family with two children and eligibility income of 32000 would qualify for 100 percent tax forgiveness.

PA SCHEDULE SP LINE 21 What is Tax Forgiveness. Lacerte will automatically complete Part C Line 1. Qualifications for this credit will depend on your eligibility income state withholdings and family size.

To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return. In the Tax Forgiveness Credit Schedule SP section enter data into the rest of the fields as needed. PA - Special Tax Forgiveness Credit.

Gifts awards and prizes- Include the total amount of nontaxable cash or property received as gifts. Determine the amount of Pennsylvania-taxable income. Because eligibility income is different from taxable income taxpayers must fill out a PA Schedule SP.

Go to Screen 53 Other Credits. Click on Pennsylvania from the top left. Fill in the oval that describes your situation.

On PA-40 Schedule SP the claimant or claimants must. Schedule SP Part C Line 6 must be completed manually for a nonresident. Special Tax Forgiveness.

Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return. Complete Tax Forgiveness Eligibility income starts with taxable income The eligibility income limit for 100 percent tax forgiveness is 6500 for the claimant 13000 for. 2 Years Ago Pennsylvania.

Single and claimed as a dependent on another persons PA Schedule SP. One easy way to file your Pennsylvania Personal Income Tax Return PA-40 and the required additional form Schedule SP is by using myPATH the Department of Revenues free online tax filing system. A dependent child may be eligible if he or she is a dependent on the Pennsylvania Schedule SP of his or her parents grandparents or foster parents and they also qualify for tax forgiveness.

Schedule SP Tax Forgiveness Credit What else do I need to know. Married taxpayers must use joint income for determining. The level of tax forgiveness decreases by 10 percent for every 250 increase in income.

Different from and greater than taxable income. The diagnostic triggers when the taxpayer may be eligible for the Special Tax Forgiveness Credit. To calculate your Eligibility Income.

Forgives some taxpayers of their liabilities even if theyhave not paid their PA personal income tax. You can click on either File a PA Personal Income Tax Return for 2020 or File a. A single or unmarried claimant determines only his or her own amount of taxable income.

Under Tax Authority or States go to the Pennsylvania Credits worksheet. It is not an automatic exemption or deduction. Visit mypathpagov to access this system.

Visit mypathpagov and look at the links under the Individuals section on the homepage. If you are filing as Unmarried use Table 1.

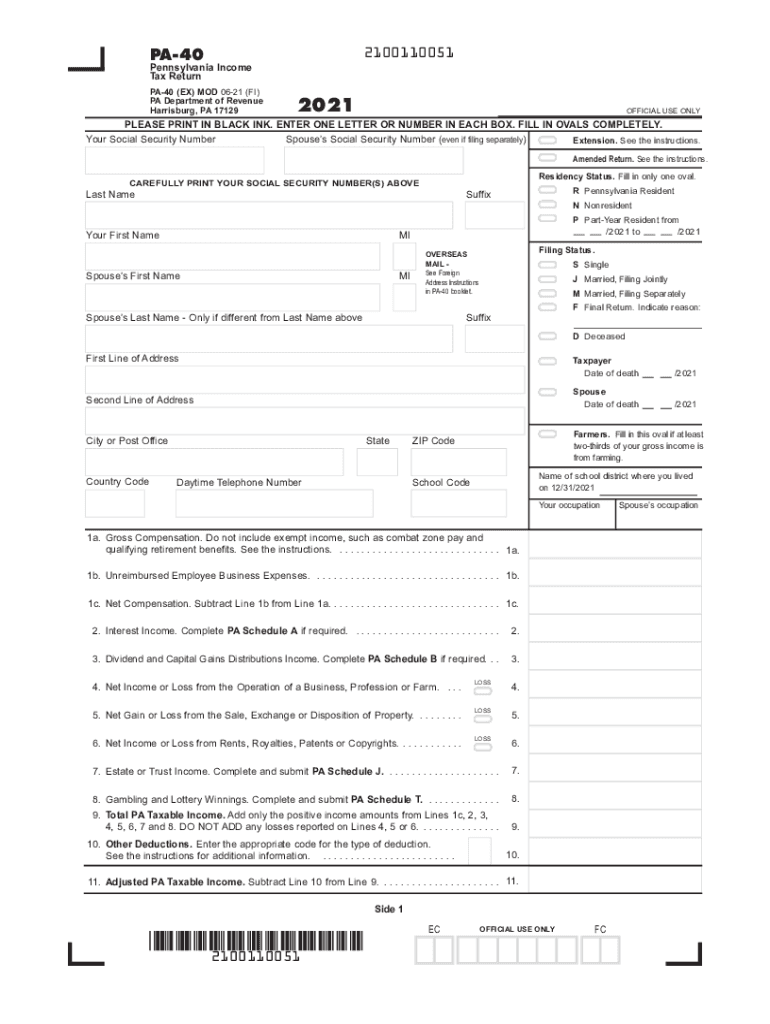

2021 Form Pa Dor Pa 40 Fill Online Printable Fillable Blank Pdffiller

Free Form Pa 40 Pennsylvania Income Tax Return Free Legal Forms Laws Com

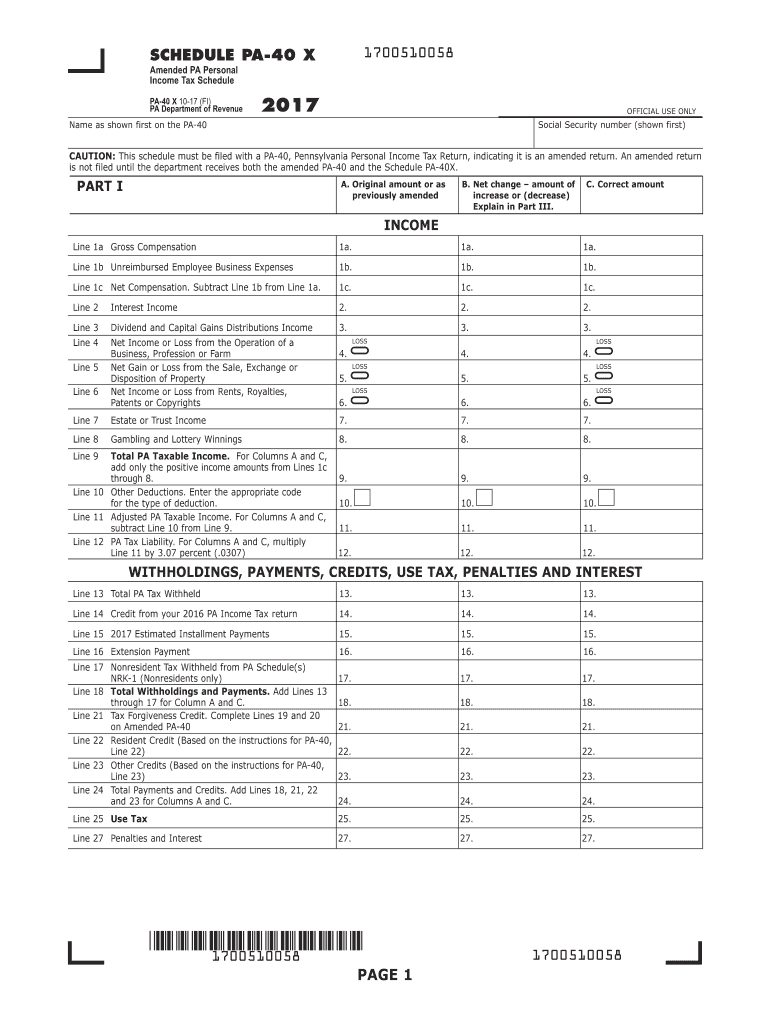

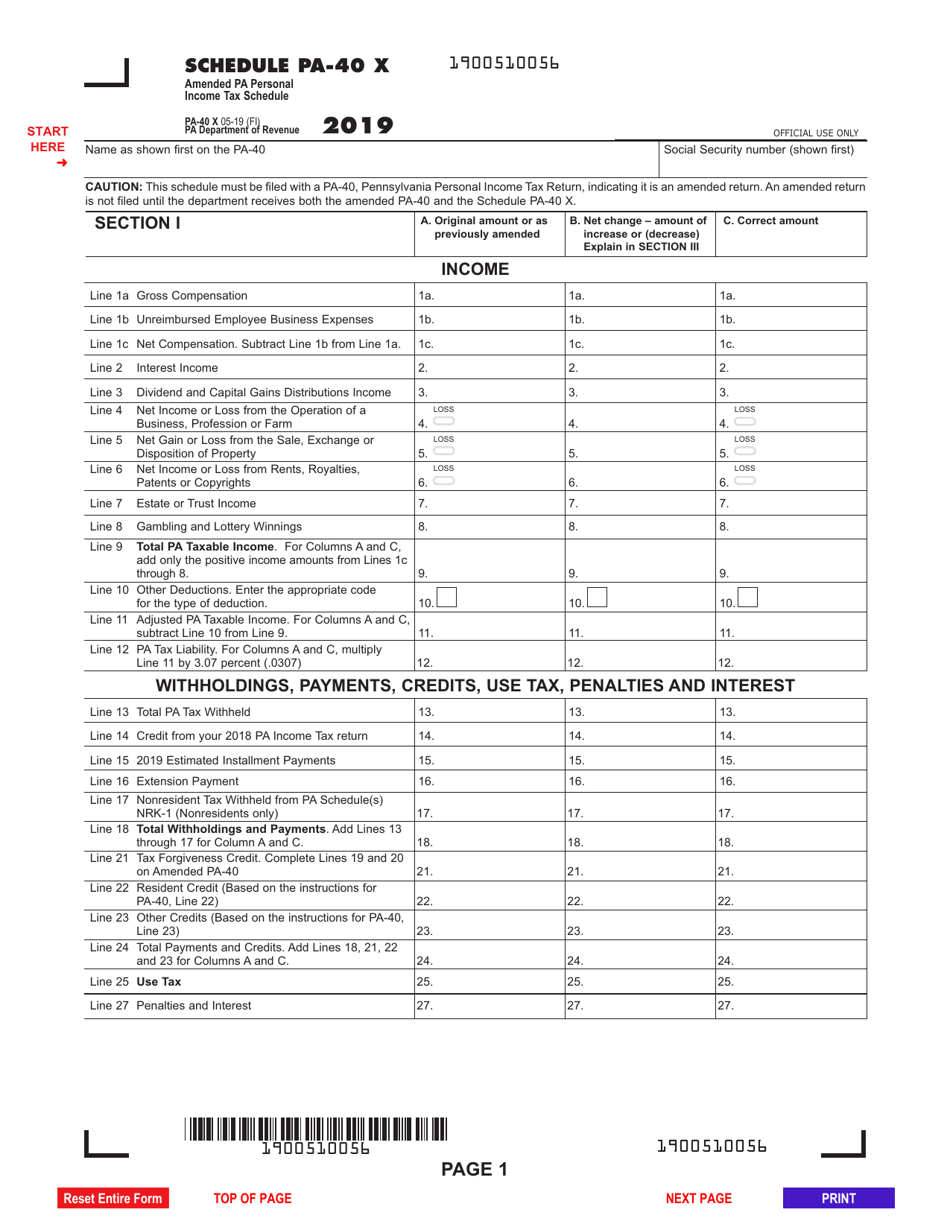

Pa Schedule Pa 40x 2017 Fill Out Tax Template Online Us Legal Forms

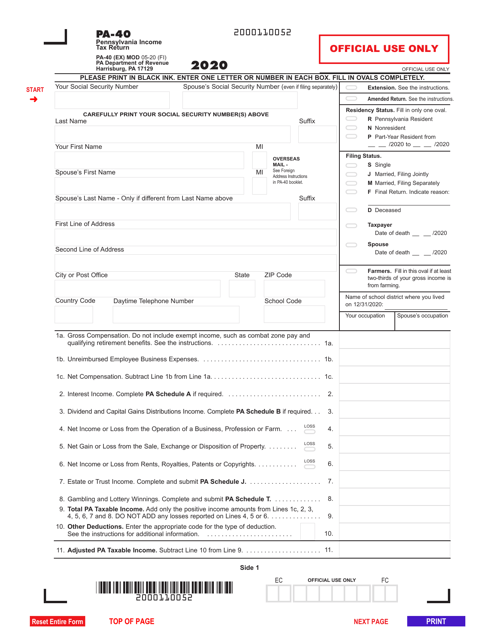

Pennsylvania Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

2011 Pa Schedule Sp 1101110052

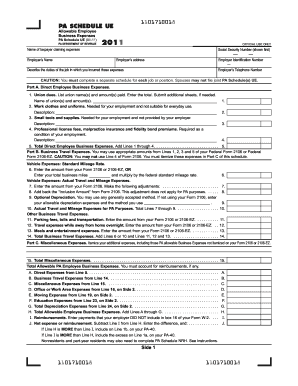

Pa Schedule Ue 2021 Fill Online Printable Fillable Blank Pdffiller

Schedule Pa 40 X Download Fillable Pdf Or Fill Online Amended Pa Personal Income Tax Schedule 2019 Templateroller

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Form Pa 40 Sp Fillable 2014 Pa Schedule Sp Special Tax Forgiveness

Pa Schedule Sp Fill Out And Sign Printable Pdf Template Signnow